The post As capacity growth and development slow, warehousing costs remain high appeared first on Crossbetter.

]]>According to developers, inventory and demand may be declining, but a significant reduction in new warehouse developments will keep vacancy rates tight and push rents up more than 10% this year. Warehouse automation is expected to drop a few notches this year, but should resume its upward trend over the next few years.

Slowing sales and rising capital costs have taken a toll on warehouse development this year, with the industry overdriven by a surge in freight volumes over the past few years, adding warehousing capacity at a frantic pace. However, by 2023, real estate giant Prologis predicts that development in the U.S. will hit a seven-year low, with construction starts falling 60% in 2022.

The firm’s analysts pointed to rapid cost increases, driven by inflation, as the biggest factor inhibiting activity, noting that many projects were also skeptical of the 2023 development as rising interest rates made immediate capital more challenging. Leasing activity should be expected to decrease by 10% to 15% but Supplemental said the absorbed area points were overtime freed up by demand which was driven primarily by e-commerce growth.

In the second half of last year, the warehousing industry showed signs of peak temperatures, led by Amazon, which hit the brakes and then turned backwards, delaying or closing warehouse projects and announcing that it would sublease facility space and offer third-party warehousing under its new warehousing and distribution brand. From the beginning of 2020 to the end of 2021, the e-commerce giant’s warehouse footprint nearly doubled.

However, the overall recession will be more pronounced in some regions than in others. Prologis expects a more intense contraction in Southern California, noting that one-third of the buildings under construction in the “Inland Empire” near Los Angeles in November were in neighborhoods where municipalities proposed or implemented a moratorium on industrial development.

Developers expect warehousing activity to grow in Texas and Mexico. The latter has been a major target for companies seeking nearshoring procurement. But a slowdown in the market won’t lower rents. According to GLP, the national vacancy rate will rise to around 4% this year from 3.3% at the end of the third quarter of last year.

Developers estimate that this may seem at odds with slowing imports and retailers’ efforts to reduce excess inventory through discounted sales, but the slower pace of development should keep capacity growth below demand levels. Prologis estimates that even if demand completely dries up, the U.S. vacancy rate will only rise to 5.9 percent this year.

With demand still outpacing capacity, Prologis expects storage rents to rise by more than 10% this year, while CBRE expects rents to rise by 12%-15%.

According to market intelligence provider Nteract Analysis, library automation is downshifting as facility development slows. The company predicts that the industry grew 28% in 2021 due to slowing e-commerce growth, with revenue climbing to $36 billion and will grow just 2% this year.

Amazonian plays a huge role in this area, and when the company stopped its pooling expansion, it caused trouble for its technology providers, with Teract’s statistics showing that as much as 35% of the pooling automation market will come from Amazon by 2021.

However, Lnteract is bullish on the long-term potential of the market and expects to rebound from the slowdown this year in the coming years. Driven by improved macroeconomic conditions and steady growth in e-commerce, the CAGR is expected to be 19% from 2024 to 2027.

Kinimatic doesn’t seem to be worried about the current slowdown in the market, a technology-driven warehousing and fulfillment network provider that announced in November that it would add more than 9 million square feet to its nationwide area, currently covering more than 30m SG ft.

Prologis also noted that warehouse starts in Europe have slowed, down 30% from their peak in Q3’22.

The post As capacity growth and development slow, warehousing costs remain high appeared first on Crossbetter.

]]>The post Manufacturing outlook points to declining US air cargo in 2023 appeared first on Crossbetter.

]]>Depending on how December 2022 numbers come out, full-year US airfreight exports in 2022 will have grown about 3%, and imports around 1%. Last year was a tale of parts, with the first part showing decent levels of growth – and the latter part recording increasing declines. Much of the decline in the second half was driven by China.

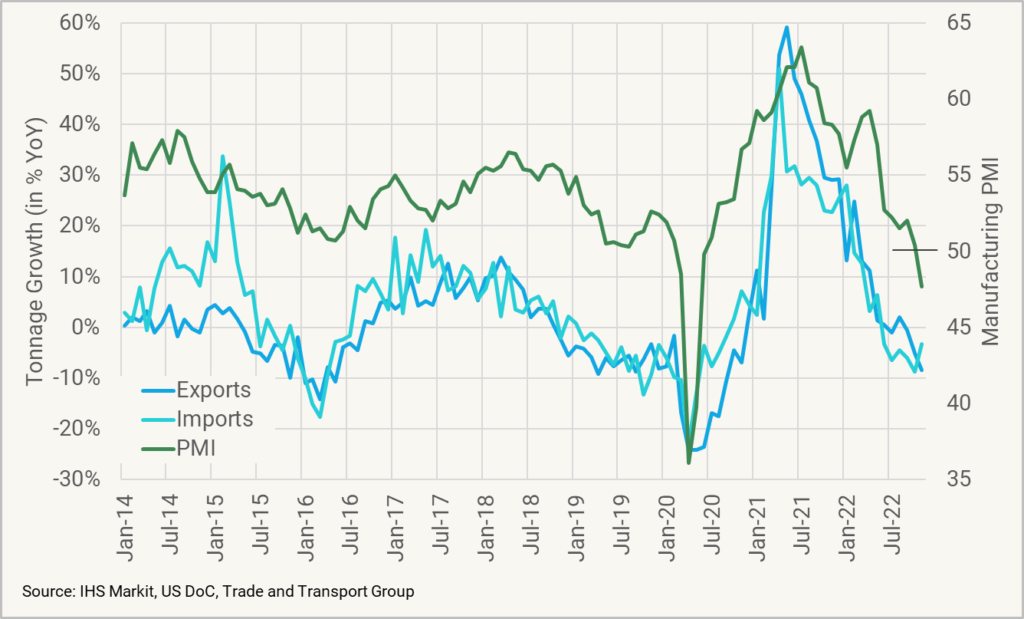

US manufacturing activity and air cargo show reasonable levels of correlation (see figure one), which intuitively makes sense, given that a large part of air cargo is intercontinental supply chain cargo.

US manufacturing has had a good run – 28 months of expansion, starting July 2020, but it started to soften in October 2022. PMIs are expected to be slightly below 50 for the first half of the year, and then slightly above 50 for the remainder. Figures below 50 point to contracting manufacturing activity.

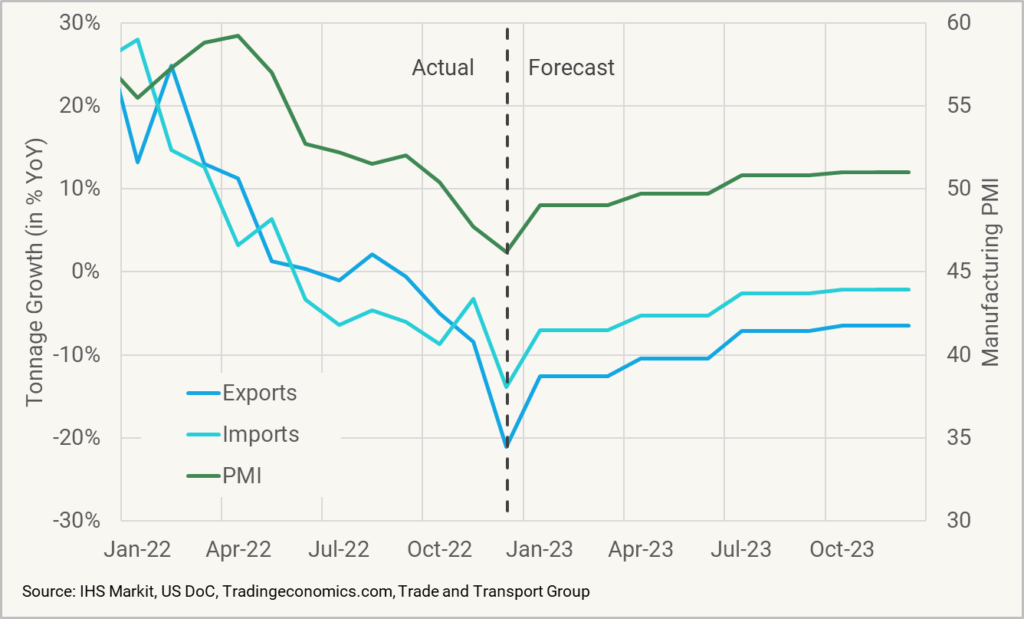

Figure 2 (below) provides a forecast for US airfreight exports and imports for the next 12 months. We expect declines to be in the double-digit range for the first half of the year and single-digit for the remainder. Let’s see in six months’ time how accurate this forecast turns out to be!

This article was provided by Trade Data Service.

The post Manufacturing outlook points to declining US air cargo in 2023 appeared first on Crossbetter.

]]>The post China’s export rate is still falling, but the transatlantic export rate is stagnating appeared first on Crossbetter.

]]>For example, last week Drewry’s WC Nordic portion fell 14% to $1,686 per 40 feet, while Xeneta’s XSI fell 15% to $2,126, and Freightos Baltic Exchange (FBX) fell 1% to $3,530 Meanwhile, last week it was seen that the FAK offered by alliance carriers included rate concessions from all Chinese ports to all UK and North Continent ports as low as $40 per 1,30 feet , valid until December 31. Last week, more unsolicited offers from Chinese freight forwarders one – rates offered through all major alliance carriers and all Nordic hub ports were as low as $40 per 1,000 feet.

However, the validity of these extremely low rate quotes is questionable as some unscrupulous freight forwarders seem to be looking for new business based on the reduced rates expected by carriers.

The shipper said his company did not take the “proposals” seriously because there was no space guarantee, adding: “We will only make reservations based on quotes for electronic parts from carriers that reference our contract number. Elsewhere, in the Transoceanic region, Asia-to-US West Coast rates eased on a spot basis, with WC down 2% this week at $1.97 per 40 grass days, XS down 5% at $1519 and FBX down 1.6% at $1.403

However, on the Atlantic coast, the Asian American East Coast component of WC| and FBX both fell 9% to $3.993 and $3.368 per 40 feet, respectively.

For ocean carriers, the only remaining pearl in terms of demand and spot rate increases is the transatlantic stay, and the combination of a strong dollar and US quarterly sellers choosing to source more products in Europe rather than China is keeping the market active, with spot WC| readings from Northern Europe to the US East Coast down slightly 1% last week to $7.151 per 40 feet, while XSI fell 2% to $7.146.

However, the FBX Nordic to US East Coast portion slipped nearly 5% to $6.056 per 40 feet.

The strong momentum in the market has prompted carriers to upgrade their tonnage on this route and see weekly capacity increase due to new entrants.

It encourages carriers to take advantage of the strong market by introducing interest rate hikes and surcharges. For example, the CMA CGM said this week that it will impose a charge of every 40 feet on cargo from Northern Europe to U.S. East Coast ports starting Dec. 2022.$1,500 PSS (Peak Season Surcharge).

The post China’s export rate is still falling, but the transatlantic export rate is stagnating appeared first on Crossbetter.

]]>